How to Budget for your Family

When a person has a serious debt problem, they need a plan for how to attack it. How to save money and take care of their family properly is a goal every person is trying to achieve. The first step in the process of taking control of your finances is to create a comprehensive budget that gives you an overview of your financial situation. This can help you get an idea of exactly where your money is going and how you can potentially save up extra money to pay down debt. Many people are unsure of how to create a monthly budget. The 6 steps outlined below will help you get on your way to financial freedom.

How To Create A Budget

To accurately determine where your money is going from month to month and where there are potential areas to find money to put towards paying down your debt you need to create a budget, but it can be overwhelming to figure out where to start. These are the steps to take when trying to create a monthly budget for your family:

- List all sources of income – this would include paychecks, benefits, tips, child support, etc.

- List all non-negotiable expenses – your housing costs such as mortgage or rent, your utilities, your grocery food costs, transportation costs including car payments, gas, and parking, and other costs that are required expenses from month to month. Things such as child support, medication prescriptions, school tuition or daycare fees, etc.

- List all negotiable expenses – these are things you spend money on that are not considered necessary expenditures. This would include items like entertainment (going to the movies, concerts, amusement parks, etc.), eating out, non-essential clothing, jewelry, toys, etc.

- Add up all of your sources of income – this will give you a total of all the money you have coming in in a month

- Add up all of your expenses both non-negotiable and negotiable – this will give you a total of all the money you have going out in a month

- Subtract the expenses from the income – If the expenses outweigh the income and you are left with a negative amount of monthly each month you will need to figure out a way to cut your expenses or boost your income level. Looking at the negotiable expenses is a good way to give you an idea of ways to save money from month to month.

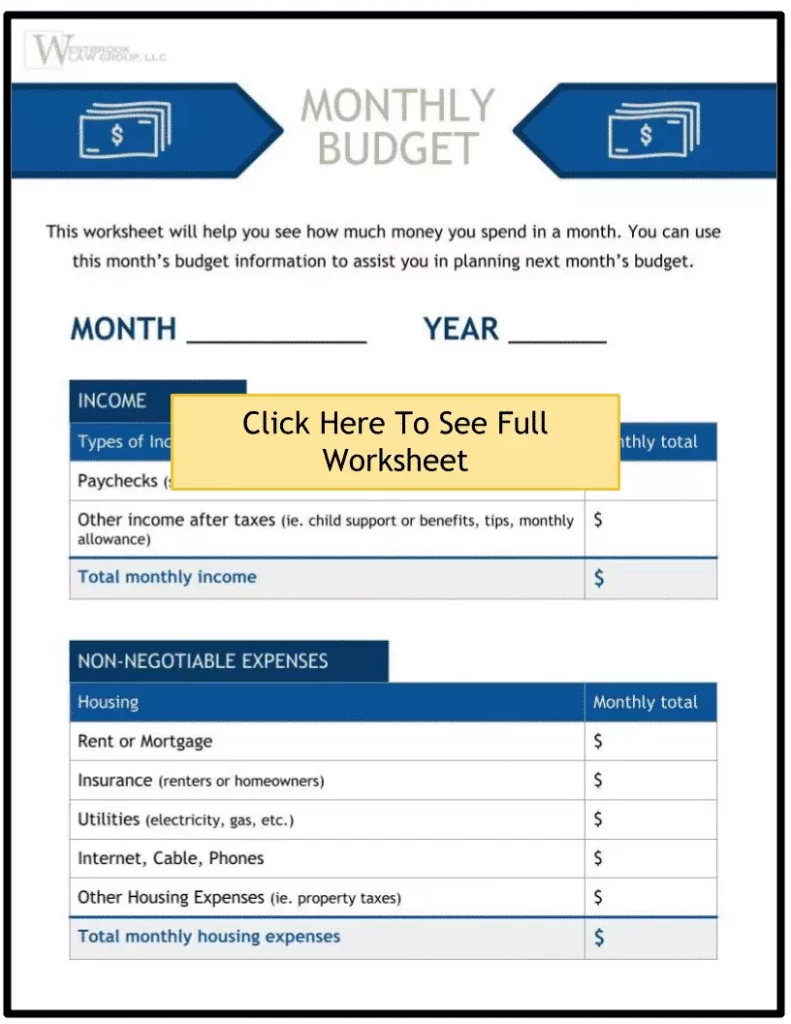

Depending on your living situation you might have a large number of expenses and it can be hard to think of them all when creating a budget. To assist you in this process we have created a handy ‘How To Create A Budget For Your Family’ worksheet. It is a printable budget spreadsheet that covers a wide range of possible monthly expenses.

Simple Budget Worksheet – PDF

This worksheet has been designed to be very thorough and provide a good resource for someone trying to get out of debt. It is also a useful tool when trying to determine if your level of debt needs to be consolidated through bankruptcy. It is vital that a person track every dollar they are spending in order to identify areas where they can save. If a person can find just $10 to save each week, that is more than $500 in a particular year. This can be the difference between getting a debt paid off and struggling to get by.

Westbrook Law Group – Monthly Budget Worksheet – pdf

Some people hesitate to make a budget because they would rather keep their heads in the sand about their debt issues. There is an “out of sight, out of mind” mentality amongst some people when it comes to thinking about how much money they spend from month to month. This is understandable as it can be extremely difficult to see exactly how much debt you are in, but it is necessary if you ever want to get your life back on track. Simply ignoring this budget or assuming it will work itself out is not enough – a person needs to create a hard and fast budget and stick to it. Having a strategy can potentially help you get out of debt and the first step of that strategy is knowing exactly where you stand financially.

Call today for a Free Consultation

When you’re in debt, it’s difficult to focus on anything else. But there are steps that you can take to get out of debt – even if your credit is damaged or your income has been cut off completely! Call our St. Charles bankruptcy attorneys at Westbrook Law Group to find out how to escape the shackles of debt and get relief in Missouri.

Learn More About Budgeting

Westbrook Law Group can discuss your debt problems and help you budget your money, should you need assistance. By closely examining your financial situation, you can determine if bankruptcy is the right option for you and your family. For a free consultation regarding your debt problems, contact our office today.

What Our Clients Say

“I highly recommend Brent Westbrook. He was so helpful and went above and beyond to answer any questions I had. His staff is friendly and responded quickly to calls and emails.”

Rating: 5/5 ⭐⭐⭐⭐⭐

Sarah Reddick

February 22, 2021

Read more of our 152+ reviews on Google!