st. louis / COLUMBIA / ST. CHARLES

Bankruptcy Attorneys

Your DEBT PROBLEMS END Here

St. Charles Bankruptcy Lawyer Near You

Types of Bankruptcy

In Missouri, there are 4 types of bankruptcy you can file under, Chapter 7, 11, 12 & 13.

At Westbrook Law Group, we practice primarily in the areas of Chapter 7 and Chapter 13. Learn more about each specific type of bankruptcy.

Chapter 7 Bankruptcy

Are you drowning in debt? Get debt relief today by filing Chapter 7 bankruptcy! Our experienced bankruptcy attorneys at Westbrook Law Group will guide you every step of the way so you can get your financial life back on track. Schedule a free consultation with us to learn about the Chapter 7 bankruptcy proceeding, eligibility, and exemptions in Missouri.

Chapter 13 Bankruptcy

Are you facing financial challenges, but don’t want to risk losing your car or home in bankruptcy? Our Chapter 13 bankruptcy attorneys in St Charles, MO can help you get relief from overwhelming debt and stress. You don’t need to make sacrifices; we won’t ask you to. Call us today to schedule a debt evaluation with an experienced Missouri bankruptcy attorney!

Get Back On Track

Bankruptcy is an intimidating and sometimes embarrassing word for people that are dealing with cumbersome debt levels. But there is absolutely nothing to be ashamed of when you are struggling and are not sure what else to do. By reaching out to an experienced financial attorney, you can begin the first step in getting yourself back on track. We can help guide you through the entire bankruptcy process whether that means restructuring your debt or discharging it all together.

At Westbrook Law Group, we can assist with a number of financially distressing situations including:

Credit Card Debt ELIMINATION

Westbrook Law Group offers the best legal help for your credit card debt consolidation needs. Our St. Charles bankruptcy lawyers will help you get out of debt and provide all the assistance you need to get your financial freedom back. If you’re struggling with credit card debt, call us to today to get debt relief in Missouri!

STOP Foreclosure

Facing foreclosure? Don’t wait until it’s too late! As seasoned foreclosure attorneys, we know the desperation that comes with the threat of foreclosure. That’s why we’re here to help you keep your home in Missouri. Schedule a consultation with us to discuss how to prevent creditors from foreclosing on your home.

STOP Wage Garnishment

Wage garnishments can leave you drained and broke. If you’re looking for a way to stop garnishment, Westbrook Law Group has your back. Our wage garnishment lawyers in St Charles, MO can help you stop creditors from garnishing your wages, so you can take back your financial freedom.

STOP Repossession

If you’re facing repossession, it’s vital that you act now. Our car repossession attorney in St Charles, MO can help you stop repossession and get your vehicle back! Book an appointment at Westbrook Law Group to find out how to stop your car from getting repossessed today.

ELIMINATE Medical Bill Debt

Dealing with unexpected medical debt? Don’t let your savings be depleted by medical bills! Our experienced bankruptcy attorneys in St Charles, MO will explain how bankruptcy can eliminate medical bill debt and guide you through your bankruptcy case. Call us today to get started.

HANDLE Student Loan Debt

With student loan debt on the rise, it’s important to have a good bankruptcy attorney who can help you understand your debt relief options and see if filing bankruptcy is for you. Call Westbrook Law Group to learn how to get rid of student debt or get help rebuilding your credit.

Our St. Charles Bankruptcy Attorneys Can Help

About Brent Westbrook

Founding Member | Experienced Missouri Bankruptcy Attorney

Brent Westbrook has built his St. Charles based law practice focusing exclusively on helping individuals and businesses in financial distress through bankruptcy. While attending law school at the University of Missouri-Kansas City School of Law, Brent competed in Bankruptcy Moot Court in New York City and also completed an internship with the Chief Bankruptcy Judge in the Western District of Missouri. Brent’s extensive experience and commitment to bankruptcy law naturally led him to pursue a career advocating for the rights of the financially distressed. Brent finished law school in 2006 and quickly became a named partner in 2008 at the largest bankruptcy firm in

Kansas City, MO; Wagoner Maxcy Westbrook, P.C. Brent Moved to the St. Louis area to be closer to family.

“As seen on NBC”

How has the pandemic affected bankruptcy filings in the Missouri? Watch as Missouri bankruptcy attorney Brent Westbrook discusses the need for financial guidance in these trying times.

Is it Legal to...

a Missouri Bar podcast

Bankruptcy law has been around since the 1800s. In this episode of Is It Legal To… explore its historical evolution and key principles.

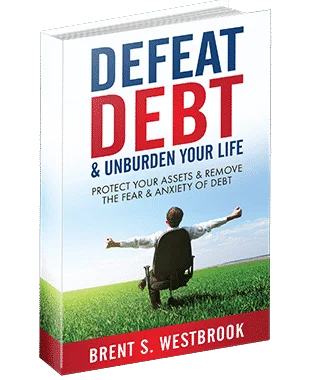

Defeat Debt & Unburden Your Life

Get Your FREE Copy Today!

Call our office today for a FREE copy of Brent’s outstanding new book “Defeat Debt & Unburden Your Life.” The book offers insight from an experienced attorney with over a decade of knowledge working exclusively in bankruptcy.

Dispel the bankruptcy myths you have heard, the anxiety you feel, and allow this book to answer the questions you have been too afraid to ask. Learn what bankruptcy can do for you and your family, and how it is actually the MOST responsible and rewarding decision you can make.

We even included a BONUS chapter! Life After Bankruptcy teaches you the steps you need to take to not only survive a bankruptcy but to THRIVE. Call our office today to request a book or make an appointment to see us so you can get all the information you need directly from the author.

A Fresh Start At Your Fingertips

Free Initial Consultation

At Westbrook Law Group, we offer FREE initial consultation — so you can find out whether bankruptcy is right for you, at no additional cost.

Personal Service From An Attorney Throughout Your Case

Our trusted Missouri bankruptcy attorneys will guide you every step of the way.

Stop: Creditor calls, Forclosure, Wage Garnishment

Find out how to get out of the chains of debt and get a fresh start today.

Determined Advocate

Our seasoned bankruptcy attorney in St. Charles & Troy, MO will assist you in your bankruptcy filing with your best interest in mind.

Evenings & Weekends By Appointment

We offer flexible appointment times, so you don't need to worry about scheduling your bankruptcy consultation.

Protect: Home, Retirement, Vehicles, Peace of Mind

Protect what matters to you most and bring peace back into your life through bankruptcy.

Compassionate Representation

Our bankruptcy attorneys understand your struggles and will treat you with the dignity and compassion you deserve.

Free Enrollment in Credit Rebuilding Program

We'll help you get back on your feet and rebuild your credit after you filed bankruptcy.

About Westbrook Law Group

At Westbrook Law Group, we’re not a cookie-cutter bankruptcy law firm — we offer personalized legal representation that are tailored to your needs. Our bankruptcy lawyers in St. Charles and Troy are here to help you through this difficult time, and we’ll de everything in our power to ensure that you emerge from bankruptcy with the best outcome possible. Call us at 636-425-2997 to schedule you FREE initial consultation and avail of our legal services.

- Personalized Services

- Compassionate Representation

- Over 15 Years of Bankruptcy Experience

- FREE Initial Consultation Available

Call today for a Free Consultation

When you’re in debt, it’s difficult to focus on anything else. But there are steps that you can take to get out of debt – even if your credit is damaged or your income has been cut off completely! Call our St. Charles bankruptcy attorneys at Westbrook Law Group to find out how to escape the shackles of debt and get relief in Missouri.

Client Testimonials

Considering filing bankruptcy? Find out what our clients think about our bankruptcy services offered at Westbrook Law Group, LLC.

Frequently Asked Questions

At Westbrook Law Group, we understand that filing for bankruptcy is an incredibly difficult step to take. For most people bankruptcy is a necessary and responsible decision to make. Bankruptcy saves people buried in debt and allows them to emerge and prosper.

At Westbrook Law Group, we understand that people considering bankruptcy are often experiencing serious financial difficulties. As a result, we work with our clients to ensure that they can afford bankruptcy by meeting with you and determining the exact services that you need so that you are not paying for legal work that isn’t applicable to your case under an arbitrary flat fee. If you are getting a quote over the phone from an office that quotes everyone the same fee prior to knowing anything about their situation – RUN, don’t walk! We have a client centered approach to determine a reasonable fee based on your situation and needs. While some of our competitors advertise extremely low initial fees, they add on fees once you have committed to filing with them. We are completely up front about our fees and will tell you exactly what it will cost to file for bankruptcy by tailoring a fee that is best for you and only you.

In most cases, yes. A Chapter 7 bankruptcy will delay any foreclosure sale that may be pending. Upon the completion of the bankruptcy, if you are still able to make the monthly payments on your mortgage, and are current on the payments you will be able to keep your home. Under a Chapter 13 bankruptcy, any amount that you may be behind on your mortgage will be wrapped up into the plan payment agreed upon by you, your creditors, trustee and the court. In this case, you will be able to keep your home as well.

As court proceedings are a matter of public record, your filing will be part of that record. That being said, it is very rare that people take the time to dig through the bankruptcy filings at the courthouse. The Westbrook Law Group takes client confidentiality very seriously. If you have any specific concerns regarding your bankruptcy and privacy issues, please alert us to them at your initial consultation.

Yes. A Chapter 7 bankruptcy “falls off” your credit report after 10 years and a Chapter 13 after 7. It is not uncommon for a person’s credit score to actually improve after a bankruptcy as they are no longer liable for the debts that were discharged. Furthermore, many banks offer secured credit cards, which require a deposit to the amount of the credit limit. As you prove your ability to pay, the credit limit may be slowly increased. We have been told by mortgage brokers that home loans are possible 2 years after a chapter 7 bankruptcy.

Recent Blog Posts

How Can I File for Chapter 7 Bankruptcy?

Seek Legal Guidance When Filing For Chapter 7 Bankruptcy in Missouri Drowning in debt can feel overwhelming and hopeless, but there may be a light

Bankruptcy and Medical Debt Relief in St. Charles, Missouri

Gain The Medical Debt Relief You Deserve Through Bankruptcy Accruing substantial medical costs can be incredibly burdensome, but there are also opportunities for potential solutions.

How Can I Save My Retirement Savings in Bankruptcy in St. Charles, MO

Keep Your Retirement Bright In Bankruptcy! Perhaps this is not the first time you have read an article after numerous searches of “How can I